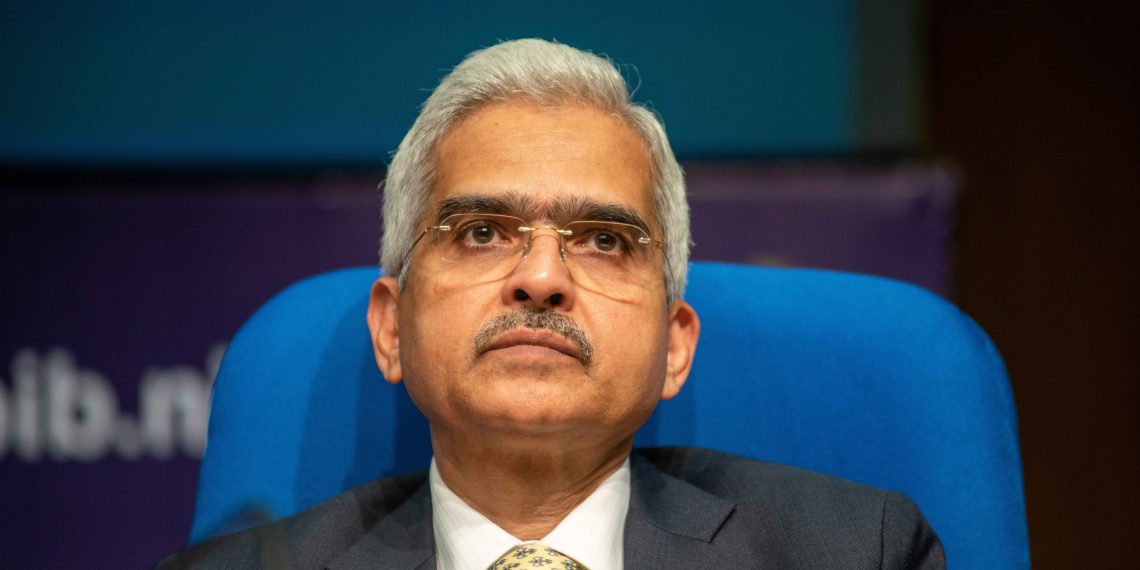

Shaktikanta Das, Governor of the Reserve Bank of India (RBI), has highlighted the transformative potential of central bank digital currencies (CBDCs) in facilitating efficient cross-border payments. According to a report from Odaily, the Indian central bank has reaffirmed the country’s leadership in digital currency adoption, being one of the few nations to implement both wholesale and retail CBDCs.

The primary goal behind India’s CBDC initiative is to simplify international transactions while addressing critical financial stability issues posed by the growing influence of cryptocurrencies. The use of CBDCs could significantly enhance the speed and cost-effectiveness of cross-border payments, providing a more stable alternative to traditional digital assets.

However, Das pointed out a significant challenge: the need for countries to design their digital currency systems in a way that aligns with national interests and regulatory frameworks. This could potentially create complexities in achieving global interoperability for CBDCs.

As India continues to push forward with digital currency developments, its efforts underscore the broader trend towards embracing technology-driven solutions in the financial sector. These initiatives not only aim to enhance transaction efficiency but also seek to reinforce financial stability amid the rapid evolution of the global monetary landscape.